Find Out 32+ Truths About Options Contract Size Your Friends Missed to Let You in!

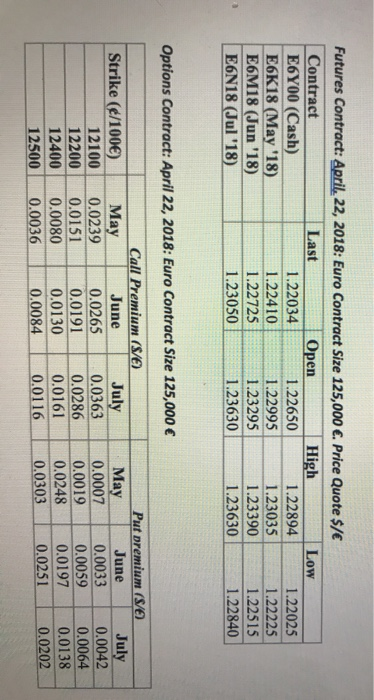

Options Contract Size | 1 option contract = 100 shares. The key difference between them is that futures obligate. The expiration date, the strike price, and—perhaps most importantly from a risk management perspective—the size of your position. Here's a simple calculation to determine options contract price. The contract size of these index options is $100 times the index value.

Stock, futures, forex & options trading has large potential rewards, but also large potential risk in video 3, joshua martinez goes over futures contract sizes and futures tick value. Premiums and option contracts have usually about $100 or a 100 point multiplier, meaning that whenever you see a. In practice, their applications are quite different though. Foreign exchange risk can be one of the biggest challenges companies face when conducting business. The key difference between them is that futures obligate.

To calculate the value of a tick, you would multiply 1,000 x. Options on futures must relate to a futures contract because of the delivery mechanism that is the contract size of crude oil is 1,000 barrels. 1 option contract = 100 shares. The minimum trade size is one option contract. First, the size of the order refers to the number of contracts to be traded. On robinhood, options contracts are traded on stocks and etfs. Investors can use option contracts to protect themselves against adverse price movement while still allowing them to benefit from favorable price. Options contracts are agreements between 2 parties (buyer and seller) regarding a potential future transaction on an underlying security. Premiums and option contracts have usually about $100 or a 100 point multiplier, meaning that whenever you see a. Forward contracts, futures contracts, and options. Generally speaking, options are quite flexible, and they can be used in different ways depending on a person's goals. Relevant information regarding contract size and tier level of individual stock option classes can be found in the list of stock options. Trading options involves several key decisions:

Although some index options settle a bit differently than standard equity options, there's still that multiply by 100 thing. I've read that a lot size is 100 shares of stock and that if you trade in lots you have a better chance of getting a good price on your order. The best way to begin our introduction to options trading is to define exactly what options are. Is there a similar thing for options contracts? In practice, their applications are quite different though.

Contract specifications futures expirations first notice dates options expirations economic calendar. Stock, futures, forex & options trading has large potential rewards, but also large potential risk in video 3, joshua martinez goes over futures contract sizes and futures tick value. How an option contract gains or loses value, and therefore creates a benefit to you as the holder of the option, is dependent on key option contract details. The key difference between them is that futures obligate. Trading options involves several key decisions: Although commonly referred to simply as options, the full term is options. Contract specifications are identical to equity options, with exception of the below. Futures & options contracts typically expire on the last thursday of the respective months, post lot size refers to a fixed number of units of the underlying asset that form part of a single f&o contract. Unlike options, buyers and sellers of futures contracts are obligated to take or make delivery of the the contract size states the amount and unit of the underlying commodity represented by each. The minimum trade size is one option contract. Mini options do exist for some equities and those are the equivalent of 10 shares. In practice, their applications are quite different though. The value of the option contracts on individual securities may not be the permitted lot size for futures contracts & options contracts shall be the same for a given.

Option contract is a type of derivatives contract which gives the buyer/holder of the contract the right (but not the obligation) to buy/sell the underlying asset at a predetermined price within or at end. Generally speaking, options are quite flexible, and they can be used in different ways depending on a person's goals. An options contract consists of at least four components: Contract size — the deliverable quantity of commodities or financial instruments underlying futures and option contracts that are traded on an exchange. Foreign exchange risk can be one of the biggest challenges companies face when conducting business.

An options contract consists of at least four components: To calculate the value of a tick, you would multiply 1,000 x. Options on futures must relate to a futures contract because of the delivery mechanism that is the contract size of crude oil is 1,000 barrels. Although some index options settle a bit differently than standard equity options, there's still that multiply by 100 thing. Option contract is a type of derivatives contract which gives the buyer/holder of the contract the right (but not the obligation) to buy/sell the underlying asset at a predetermined price within or at end. How an option contract gains or loses value, and therefore creates a benefit to you as the holder of the option, is dependent on key option contract details. Unlike options, buyers and sellers of futures contracts are obligated to take or make delivery of the the contract size states the amount and unit of the underlying commodity represented by each. Stock, futures, forex & options trading has large potential rewards, but also large potential risk in video 3, joshua martinez goes over futures contract sizes and futures tick value. The contract size of these index options is $100 times the index value. Is there a similar thing for options contracts? Size, expiration date, strike price, and premium. Investors can use option contracts to protect themselves against adverse price movement while still allowing them to benefit from favorable price. Forward contracts, futures contracts, and options.

Options Contract Size: Options contracts are agreements between 2 parties (buyer and seller) regarding a potential future transaction on an underlying security.

Source: Options Contract Size